Ecommerce: Is your growth based on being lucky or being good?

What are the 10 battle zones that companies need to face to stay competitive once the Corona tailwind fades? Are you succeeding because you’re good? Or just lucky?

During Covid, almost all eCommerce companies, retailers, and brands playing in the eCommerce space have experienced extraordinary growth and increasing profitability. The Corona Pandemic lock-down has given the industry a significant boost due to closed stores and decreased spending in other categories such as travel & leisure. This means that eCommerce has essentially been riding a wave – and thoroughly enjoyed the ride!

This new high on overall eCommerce penetration is partly owed to new customer groups that have otherwise traditionally been reluctant to move online. As a result, the eCommerce industry is larger than ever – the “cake” has been expanded.

However, continuing these levels will be extremely difficult, and we foresee that only the most professional eCommercers will be able to continue growing in the coming years.

Increased competition and lower growth rates

First of all, what many have forgotten is that prior to covid, the competition was already increasing, and growth rates were lower than many had been used to in the first waves of the eCommerce era. As a consequence, it is not surprising that growth rates are now declining to more moderate levels.

Not just because physical stores have opened again or because of the global supply chain situation and the difficulties of getting access to goods. Companies are back to looking at areas that are tougher to affect in order to improve or sustain growth.

The question here – with Corona in hindsight – is: Were you mainly lucky or are you professional enough to continue your growth trajectory? If your growth is suddenly disappearing, you were probably just sailing along in the strong corona wind. Thus, you were lucky…

The good news is that you just need to focus on the things that are really moving the needle in eCommerce in order to progress from luck to being a true professional and top-performing eCommerce shop. Another piece of good news is that most of your competitors aren’t really there yet either.

But where should you focus to move the needle in your company?

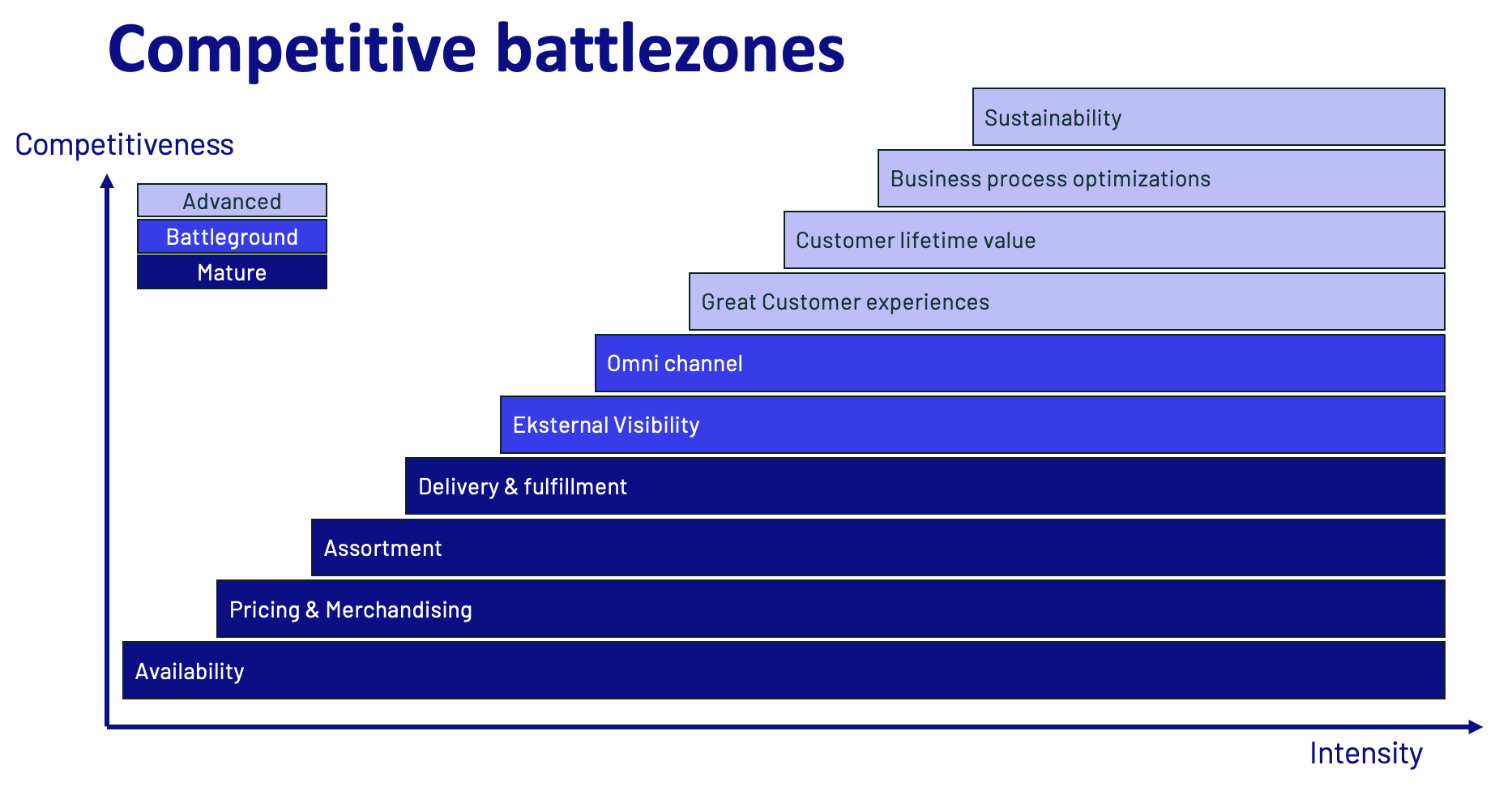

In our experience, what moves the needle in eCommerce are the areas that we have chosen to call “competitive battle zones” covering a combination of market and internal perspectives/capabilities. We call them battle zones because they represent areas that all eCommerce shops need to continuously battle to stay competitive.

We also call them battle zones, because being skilled in one zone will unleash further growth. There is one catch to it, though: The more competitive the market is, the more battles you need to be active in to continue your growth.

Our goal with this article is to help you navigate and focus your efforts because we believe competition and growth will be significant fiercer in the coming months and years. We want to help you become more than just lucky.

The competitive battle zones

We have both been part of the eCommerce industry for the past 10 years in various roles, and it has become clear to us that the competitive factors on which eCommercers compete have been somewhat similar across B2C categories and industries. We foresee that B2B companies will face some of the same factors in the future if they haven’t already.

When looking at competitive factors and the intensity of competition, we have identified 10 mutually exclusive battle zones. These are characterised as staying battles, that companies need to face. However, as growth decreases and competition gets fiercer, more battle zones open up, and companies will start to show whether they are skilled or just lucky.

The identified battle zones are described in the graph below:

The 10 eCommerce battlezones Before we jump into each battle zone, the graph should be read as the 10 battle zones that open up as the market intensity increases. The more battle zones that are open, the more pressure (headwind) eCommerce organisations will meet. Finally, we do also see that each battle zone evolves individually, hence they stay as a battle zone, that companies continuously need to focus on.

1. Availability

Back in the early days of eCommerce, and when the eCommerce market exploded under the Corona shutdown of stores, it was almost sufficient just to be open and have goods on the stock in order to grow and build success. We saw even small local stores opening eCommerce shops and managing to make significant sales.

However, as the competitive intensity increases, availability also shifts from its own channel towards being present and available on other platforms too e.g. marketplaces. We see a move from having products in stock in your own warehouse as the “king of eCommerce offering” to a more mixed picture where brands are now much more advanced in delivery meaning that you can have a long tail of products that are not in stock but available for same delivery time as from you own warehouse.

We see this development continuing as brands are suddenly also “upping their game” and providing API’s and delivery in a competitive fashion

2. Pricing & merchandising

The next level of competitiveness is pricing. Because digitalisation brings transparency to everything, then your prices need to be right. Have an attractive offer. You might sell an overpriced product to a customer once, but not many times. This is a major factor in competition, and in lower levels of competitive intensity, your prices need to be about right from an overall perspective.

However, when competition intensifies, your prices and AdWords need to be perfectly aligned, because you only win the sales button with the right price at the right time. Otherwise, you are irrelevant, and even your best customers know it. Having a pricing strategy/plan and a structured approach to trading & merchandising is a prerequisite.

This is required to go from relying mainly on promotions to having a focus on the individual customer to give the next product/experience that creates the great NPS and loyalty. In order to provide this, you need to move the experience we know from physical shops to your website – right product, the right price, right context at the right time! How optimised are your key trading drivers such as product sorting, site search, promotions, and use of home page to drive traffic to the right lists and products?

3. Assortment

The next competitive level is about your assortment. In all simplicity, it is about having the product that the customers want. And nursing your approach to the assortment is the main source for above-market level growth and the most effective way to affect your average basket size. At low levels of competition, your assortment width is key to success.

However, as competition intensifies, competition shifts towards width AND depth, and how you work with the descriptions and product details in a way where customers understand and like.

That is why many companies lately are working with PIM systems (Product information Management systems). One common mistake, however, is that companies are simply just putting their ERP data into the PIM platform. But that will NOT give you a competitive edge as data quality does not change significantly. Another aspect that is increasing in importance is whether to make your assortment available at marketplaces.

This is a strategic question in itself: Can the risk of losing control be managed and does the short-term sales and long-term positive brand effect for your store outweigh this risk? Moving towards making your assortment available in marketplaces we would normally recommend focusing on products with high customer satisfaction, easy fulfillment, and low return rates.

The key to winning in this battle zone is to understand your customers’ preferences and the costs of product onboarding, and how you find the optimum between the two. You should aim to strike the right balance between assortment width and depth.

Many companies increase width too much to increase growth/AOV, but then face being less relevant and losing their previous “category-ownership”. Customers do not follow why a broad range of product types are introduced in the shop, and internally the company losses track of its core assortment driving unprofitable baskets.

4. Delivery & fulfillment

The next competitive level is a tough one, and the last of the mature level, which indicates that it has been a competitive factor in the eCommerce industry for many years. People want their products conveniently and fast. Their requirements change rapidly as the biggest players establish new standards. Delivery and fulfillment are properly the most important factors in projecting if you’ll see the customer again, as well as the profitability of the eCommerce shop.

At lower levels, customers’ expectations to fulfillment are lower, but as competition grows, multiple delivery options need to be in place, as well as stringent communication across all touchpoints to succeed. This will be both complex and expensive for most e-tailers, which is why winners in recent years have been those who really know how to optimise their logistic setup.

We foresee fulfillment will move from a slow-moving process with long platform and vendor cycles to a “system of innovation” a lot of disruption/new methods is coming fast in the next 1-3 years, just look at last-mile delivery how much Corona has changed perspectives here.

During the Coronavirus shutdown, Amazon saw an increase in bad customer reviews. Not because of product disappointment, but because the shop promised an earlier delivery than could be achieved in the pressured market. Delayed deliveries were perceived as a let-down and infested the entire customer experience. Delivery and fulfillment are also the roots of most customer service requests in call centers.

5. External visibility

In recent years, more and more companies understand the importance of SEO and SEM, and they are investing hugely in those areas. Not least because Google and Facebook have made it extremely tangible to follow on daily basis. However, as of intensity increases, this battle zone starts to focus on your web quality score and performance and your visibility on all sorts of Social Media Platforms.

We identify this as the battle zone that most eCommercers are fighting right now. SEO screen space has been limited due to Google shopping and Google ads by SEO but is still important. SEM has turned into a data game where the granularity, precision of your Google Shopping feed is key – and with huge automation, this becomes less of a differentiator. And social media’s role as either just a top-funnel activity or a scalable transaction generator is constantly a dilemma to review.

In short, you need to utilise these standardised processes and platforms but also focus on creating differentiating messaging, and we expect that this space will become more and more crowded while competition will intensify significantly over the next couple of years.

6. Omnichannel experiences

The next competitive level is particularly relevant for those companies that have stores or physical businesses in addition to their eCommerce. Here, omnichannel is the hot buzzword of the battle zone. It typically all begins with a need for an app, where the company can interact with their customers on their own terms and outside the screaming marketplace.

As competition intensifies, many different consultants try to nail “true omnichannel” – however, omnichannel is a Nirvana that no company has reached or will ever reach – But they all strive for it. In reality, connecting physical and digital experiences, stocks, prices, promotions, marketing efforts, etc. is complex and extremely expensive.

The key learning for us in recent years has been to focus more on what companies can do well instead of investing a lot of money in initiatives that neither business nor customer will ever use. But hey, you are more omni after the investment.

As you can hear we have probably seen our fair share of overpromising Omnichannel slides and marketing material. What we do like about Omnichannel is to look at it as another point of data and customer experience and then find the value for businesses and customers.

Omnichannel is much more than all the features that companies want to build.

Omnichannel is to basically serve your customers well regardless of where and when you serve them. A good place to start is to try to understand the true value of each channel and how/where they generate value for each other or together. Despite our quite cynical view on omnichannel, we do see it as an intense battle zone now and in the coming years.

7. Great customer experiences

In the more advanced levels of competitive factors, some eCommercers start to realise that the next step besides what already has been mentioned is to make great customer experiences. We all know the few great experiences that we actually talk about with friends and family.

Here we are not just talking about a good check-out flow with strong conversion rates. Here we see a great dedicated customer experience that differentiates the company from its competitors.

Besides finding the selected few experiences fitting your offering and doubling down on this to make a great experience for your customers, access to data is increasingly a must to deliver this experience.

However, due to privacy concerns and regulatory laws, a loss of third-party cookies has led to challenges when trying to track and understand buyer behavior online and use this to personalise the experience or create the optimal relevance for customers in general when meeting your brand.

The first step for everyone is therefore now to take control of their first-party data and use those insights to make the right decisions for their business and deliver on the all-important customer experience.

We call this area an advanced battle zone because building truly great customer experiences requires things: great people, great data, and a flexible system landscape that can serve a great digital experience.

This requires that you have separated your system landscape because you have hit the glass ceiling of growth within your standard platform such as Shopify, Salesforce, SAP, etc. Great customer experiences are your first step towards customer loyalty and highly satisfied customers (NPS).

8. Customer Lifetime Value

The next competitive level is also quite advanced because here companies are competing on Customer Lifetime Value (CLV). But competing on CLV requires that you know your customers across all the different touchpoints you are using.

Nowadays most companies have identified that they need a Customer Data Platform (CDP) for collecting all the data they can get from the different touchpoints. However, most companies we have met have no idea of why they need it and how to generate value from it.

Recently, the Danish association for E-tailers (FDIH) launched its first half 2021 results, and they show that the staggering number of 70% of all eCommerce purchases are bought in a webshop that the customer has used before. Therefore, all companies in the intensive competition will need to understand their customers’ frequency, engagement, recency, and monetary value.

This requires advanced skills and systems to help companies navigate through the jungle of marketing automation tools claiming they can do this automatically for them – because they really cannot. And first and foremost, it starts with identifying which customer journeys and/or moments of intent you need a CDP to improve.

Or maybe starting somewhat smaller by just knowing which products generate the most profitable orders in an identified timespan will make it much easier to start with and generate value from.

Basically, start by serving your customers with the absolute best experiences and products, because the higher they evaluate the next experience they have the more likely is it that you’ll see them again, hence higher CLV. We, unfortunately, see companies tend to propose products and experiences with high margins but lower customer satisfaction scores, which will erode your CLV. So, start small – simply by promoting your best experiences/products.

9. Business revenue, cost & process optimisation

The next level of competitive battle zones is quite internally focused, and some might argue that it should be lower on the list. However, most E-tailers can thrive in their market and still be sloppy on the business costs and business processes. Mainly because money is cheap in the market and eCommerce shop valuations are way beyond sky-high.

We do see some retailers (actually, the most advanced) starting to be very cautious about creating profitability from lowering costs and investments in systems and processes.

Here is key to competition that you understand how stuck you are on your system landscape and how efficient and agile you can handle new customer requirements or market trends with high quality. A small example is a fact that many shops really don’t understand the cost of a customer request in customer service.

We know from large companies that efficient customer service organisations use roughly 8 euros per customer request as a benchmark. The best companies know and understand the cash contribution from each order coming in daily. They track all cost components in their P&L at unit/basket level and have a clear view of where costs should be heading in order to turn into a competitive advantage.

As headwind increases, companies really need to start working on their cost and process effectiveness. As a clear consequence, we see the frontrunners starting to focus on POAS instead of ROAS, which requires a full and transparent view of P&L and customer feedback in order to buy AdWords on profitable and extraordinary great customer experiences.

10. Sustainability

The final competitive level, as we see it, is sustainability. When companies are performing well on all the other parameters, they can start to compete on sustainability. Yes, we know CSR and sustainability is all over the world and media nowadays. But we also need to be realistic – if growth and profit do not exist, you are running out of business.

But if you have all the other things in place, we sincerely believe that you are an advanced player, and you can run a credible “sustainability play”. To start with work on the most obvious elements within packaging material, box sizes, etc. And follow key market developments to stay a little ahead of the curve.

As the next step, the full impact created by your company in the whole value chain and the individual products/parcels going to customers will most likely be an area to focus on. We recognise that it is hugely important, however, we know it requires massive data and insights to really move the customer significantly on sustainability. But we will be very naïve if we did not believe that this would be a battle zone in the future.

Battle zones – and then what?

We want to turn the attention to the competitive battle zones since we believe that an understanding of these, how they affect you, and how you can work on them is an essential starting point.

You need to have an educated view on how you address each of these. And as a next step, you need to decide where you double down in 2022 to get back ahead of the curve in your competitive landscape – in other words, you need to master the battle zones to gain a true stronghold. Because it still holds true that “What you spent your time and attention on is typically what you get to be really good at….”

In order not to make it too philosophical we want to highlight a few things you can do already now. You can start reflecting on the following five crucial questions in relation to the battle zones.

-

Where do you spend most management time and focus – and is this the right priority?

-

Where do you invest and is your investment focus correct and balanced?

-

Do you have the right and best people in each battle zone – and do you have sufficient diversity to solve and master each battle zone?

-

Are you using data sufficiently to make and improve your battle zone performance?

-

Which competitors are you looking at – who is winning each battle zone?

Our experience is that these meta-questions are often overlooked and under-discussed when daily business kicks in.

We also highly recommend that you get closer to what happens in customer services and get a better understanding of your data foundation – because it is in the details from the battle zones you can detect whether you are lucky or actually doing things really well.

We sincerely hope that you like this article, and hopefully, it sparked engagement to go back and review some of your activities. If you want to continue the conversation, please do not hesitate to reach out to either Toke Lund or Carsten Pingel.

About the Authors

Toke Lund has been working within management consulting, heading up the strategy office and the consumer insights office at the LEGO Group, driving digital transformation at Salling Group, and working as a digital strategy consultant at Novicell.

Now Toke has founded Enterspeed, which is a software company delivering a high-performance product called the Headless Hub. Enterspeed wants to challenge traditional digital development and offers developers and businesses a premium experience with more control, flexibility, and high performance at their fingertips.

Carsten Pingel has been working within digital strategy and business development for the last 15 years. Former experience includes acquiring and scaling high-growth multi-brand eCommerce businesses and enabling digital transformation in the largest Nordic media group, Egmont, business development and strategy at Copenhagen Airports, and board positions in high growth eCommerce & SAAS companies.

Now Carsten is leading the strategy consulting unit within Valtech, that helps companies in their digital transformation and utilise data to accelerate growth.

Also check out their joint articles Surviving the Ecommerce Industry – Porter style or perhaps Massive digital business leadership challenge: Profit before Growth.

CEO and Partner at Enterspeed. Speaker on digital transformation and the future of Enterprise tech. Loyal lover of Liverpool! ⚽❤️